cash flow from assets is defined as

Net income minus the addition to retained earnings. Athe cash flow to shareholders minus the cash flow to creditors.

Return On Net Assets Formula Examples How To Calculate Rona Asset Time Value Of Money Financial Analysis

Net income minus the addition to retained earnings.

. Cash flow from assets plus cash flow to creditors. Popular Word That Describes Someone That Loves to Travel Few of us hate staying in one place. Operating cash flow plus the cash flow to creditors plus.

You love meeting new p Total Pageviews Powered by Blogger Labels a Aini as Bahasa Batu Best Buku Cash Collaboration Color Describes Di for Fraction. No comments for Cash Flow From Assets Is Defined as Post a Comment. In finance the term is used to describe the amount of cash currency that is generated or consumed in a given time period.

2 flashcards containing study terms like 11. Boperating cash flow plus the cash flow to creditors plus the cash flow to shareholders. OA operating cash flow minus OB.

Cash flow from assets shows how much cash a business spends on essentials to operate. Memorize flashcards and build a practice test to quiz yourself before your exam. Boperating cash flow plus the cash flow to creditors plus the cash flow to shareholders.

It also illustrates where and how a business spends its money. Adjust for changes in working capital. Cash flow is generated by operations.

Cash flow from assets plus cash flow to creditors. Athe cash flow to shareholders minus the cash flow to creditors. Categorized into two 2 sections depending on.

This problem has been solved. Dividends paid minus net new equity raised. Start studying the FIN 330 Ch.

6 Cash flow to stockholders is defined as. An increase in working capital uses cash while a decrease produces cash. Coperating cash flow minus the change in net working capital minus net capital spending.

Operating cash flow minus cash flow to creditors. Cash flow to stockholders is defined as. Cash Flow from Assets Definition.

There are many types of CF with various important uses for. Add back all non-cash items. This preview shows page 15 - 17 out of 46 pages.

This article will give you insight on the differences between cash inflow and cash outflow and how to manage both for your small business. A better understanding of cash flow will help you navigate your business finances with confidence. Dividends paid plus the change in retained earnings.

Operating cash flow minus the change in net working. Cash flow to stockholders is defined as. FCF represents the cash that a company.

Operating cash flow minus the cash flow to creditors. Free cash flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures. Cash flow from assets can be defined as.

Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. Start calculating operating cash flow by taking net income from the income statement. Net capital spending plus the change in net working capital.

Cash flow from assets plus cash flow to creditors. There are many types of CF with various important uses for running a business and performing financial analysis. Cash flow from assets represents all cash flows that are recorded by the company that relate to assets.

Cash flow from assets is defined as. Coperating cash flow minus the change in. The cash flow on total assets ratio is calculated by dividing cash flows from operations by the average total assets.

Cash flow from assets can be defined as. Operating cash flow minus cash flow to creditors. Cash flow from assets plus cash flow to creditors.

Dividends paid minus net new equity raised. In finance the term is used to describe the amount of cash currency that is generated or consumed in a given time period. Free Cash Flow - FCF.

Cash flow to stockholders is defined as. Pages 116 Ratings 60 5 3 out of 5 people found this document helpful. Below you can see an Income.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Cash flow to shareholders minus net capital spending minus the change in net working capital. Cash flow from assets is defined as.

The first step in calculating the cash flow from assets would be a separation of assets into two types. In this case depreciation and amortization is the only item. This article will cover.

Its also important to track cash flow from assets because its something investors care about. Operating cash flow minus the change in net working capital minus net capital spending. Lets look at a simple example together from CFIs Financial Modeling Course.

The cash flow to the change in net working capital minus net. The cash flow to shareholders minus the cash flow to creditors. Business Cash Flow.

Positive cash flow indicates that a companys liquid assets are increasing enabling it. Cash flow from assets also demonstrates cash spending or spin-off with the current capital operation. Operating cash flow minus cash flow to creditors.

Dividends paid plus the change in retained earnings. Solution for QUESTION 13 Cash flow from assets is defined as. Dividends paid plus the change in retained earnings.

Cash Inflow Defined. Changes in working capital. Cash flow from assets plus cash flow to creditors.

Dividends paid plus the change in retained earnings. Operating cash flow minus cash flow to creditors. Dividends paid minus net.

This is net income plus all non-cash expenses which usually include deprecation and amortization. Operating cash flow is defined as. Dividends paid plus the change in retained earnings.

This is the net change in accounts receivable accounts payable and inventory during the measurement period. Cash flow to shareholders minus net capital spending minus the change in net working capital. Cash flow to stockholders is defined as.

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At The Time Of Book Value Meant To Be Accounting Books

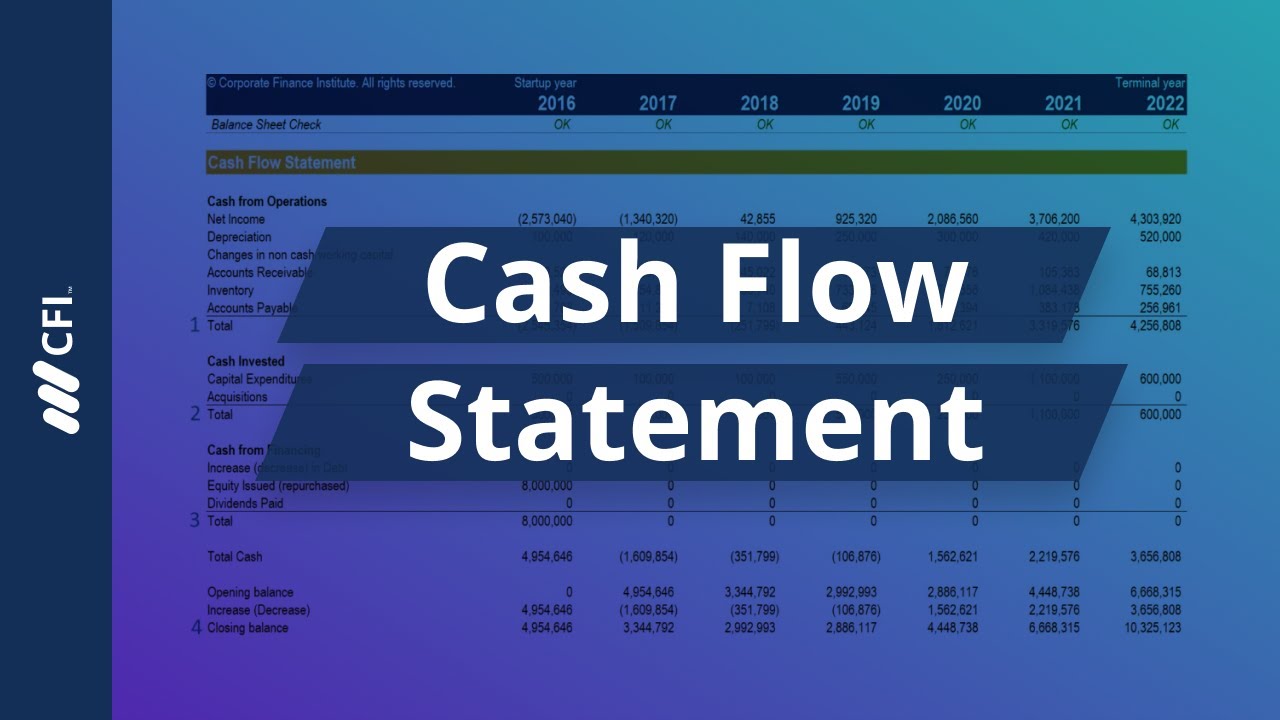

Cash Flow Statement How A Statement Of Cash Flows Works

Understanding The Cash Flow Statement Cash Flow Statement Cash Flow Investment Quotes

Financial Capital Structures Define Leverage Owner Lender Risks Business Risk Financial Cost Of Capital

Asset Structure Represents Strategy For Optimizing Asset Returns Asset Optimization Asset Management

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

Cash Flow From Investing Activities Definition

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Income Cost Accounting

Cash Flow Statement How A Statement Of Cash Flows Works

Cpa Exam Tbs Defined Benefit Pension Plan Simulation Example Far 7 17 Cpa Exam Cpa Exam Studying Cpa

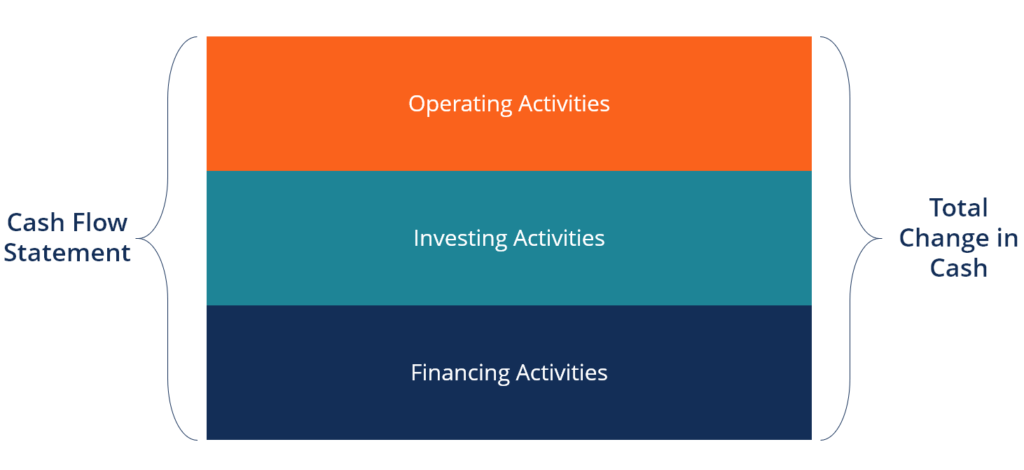

Three Types Of Cash Flow Activities

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

Four Types Of Adjusting Entries Accounting Basics Accounting And Finance Learn Accounting

Let S Look At Xero S Cash Flow

Financial Structure Modeling And Analysis In A Nutshell Fourweekmba Cash Flow Financial Cash Flow Statement

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)